Introduction: The New Frontier of Solar Innovation

The global photovoltaic industry stands at a critical inflection point in late 2024. As nations accelerate renewable energy adoption, a technological arms race has erupted among China’s solar titans – Trina Solar, Canadian Solar, JinkoSolar, LONGi Energy, and JA Solar. At the heart of this conflict lies TOPCon (Tunnel Oxide Passivated Contact) solar technology, the breakthrough cell architecture achieving record-breaking efficiencies exceeding 24%. Unlike previous solar patent skirmishes, these battles span continents and involve unprecedented financial stakes, with single lawsuits now exceeding $150 million in claims. This high-stakes competition reflects the fundamental strategic value of TOPCon technology: its seamless compatibility with existing production lines offers manufacturers a rare combination of performance enhancement without revolutionary retooling costs. The resulting concentration of patent warfare surrounding TOPCon innovations has transformed corporate boardrooms into war rooms and factory floors into intellectual property battlegrounds.

Section 1: Anatomy of TOPCon Technology Dominance

The Technical Edge Driving Conflict

TOPCon’s crystalline silicon architecture represents the most significant photovoltaic efficiency leap since PERC technology mainstreamed. Its core innovation lies in the nanometer-thin tunnel oxide layer that minimizes electronic recombination losses, enabling 25.8% certified cell efficiency compared to PERC’s 23% ceiling. This 12% performance differential translates to a devastating competitive advantage in utility-scale solar farms where marginal gains dictate winning bids. Unlike next-generation tandem cells requiring complete manufacturing overhauls, TOPCon modules can roll off retrofitted PERC lines with under 15% capital expenditure increase – an irresistible value proposition in an industry characterized by razor-thin margins.

Patent Land Grab Accelerates

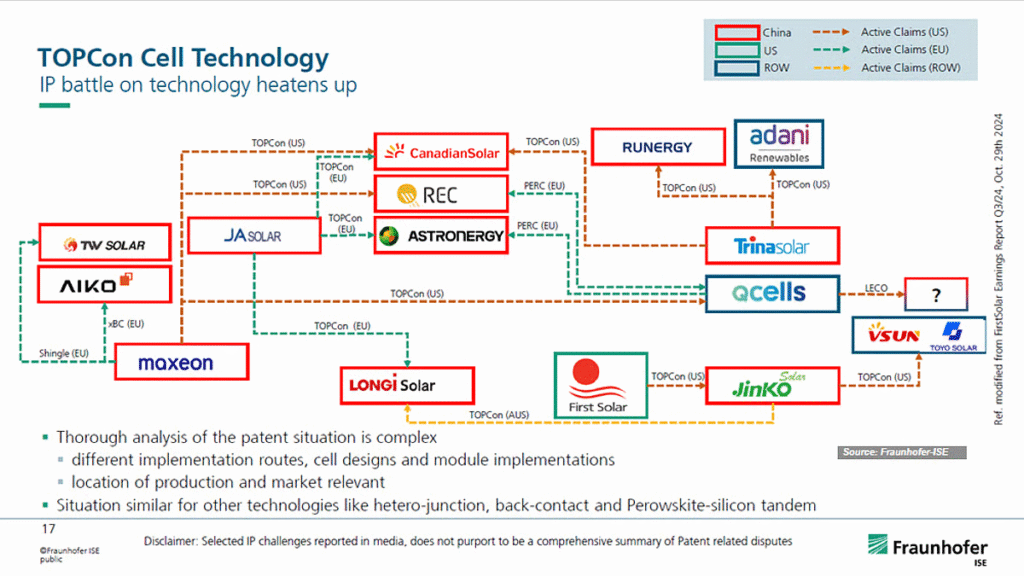

Over 4,200 TOPCon-related patent applications flooded global patent offices in 2023-2024 as manufacturers raced to stake claims. Analysis reveals Chinese applicants dominate with 78% of priority filings, dwarfing European (12%) and American (7%) counterparts. This filing frenzy follows the classic technology adoption curve pattern: when a promising innovation nears commercialization inflection point, intellectual property becomes the primary competitive moat. The strategic patents emerging from this scramble focus on three critical areas: novel deposition techniques for tunnel oxide layers, proprietary doping methodologies for polysilicon contacts, and advanced module interconnection systems minimizing efficiency losses.

https://taiyangnews.info/technology/rising-ip-disputes-complicate-topcon-expansion

Section 2: Cross-Border Legal Firestorm

Case Study 1: Trina Solar vs. Canadian Solar ($156M Showdown)

The Billion-RMB Opening Salvo

February 11, 2025, witnessed the launch of two thermonuclear lawsuits in Jiangsu Provincial High People’s Court. Trina Solar accused Canadian Solar subsidiaries of infringing foundational patents covering “Solar Cell Modules” and “Solar Cells and Their Manufacturing Methods” – patents that read directly on core TOPCon manufacturing processes. The combined 1.058 billion yuan ($156 million) damage claim represented the largest patent infringement demand in solar industry history.

Transatlantic Litigation Escalation

Simultaneously, Trina Solar triggered a multi-pronged assault in the U.S. District Court of Delaware, alleging violations of corresponding American patents. Within weeks, they compounded pressure through a U.S. International Trade Commission (ITC) Section 337 complaint – the solar sector’s most powerful trade weapon that could block Canadian Solar imports at American ports.

Canadian Solar’s Counterstrike Strategy

October 2024 counterclaims in Suzhou Intermediate Court sought 100 million yuan ($14.7 million) for alleged infringements of Canadian Solar’s own TOPCon patents. The tactical timing revealed a sophisticated legal playbook: establish parallel litigation fronts to create settlement leverage. Adam Walters, Canadian Solar’s Americas General Counsel, publicly dismissed Trina’s claims as “frivolous,” framing the dispute as a test of “whether our proprietary TOPCon technology truly infringes” while highlighting their own portfolio of thousands of solar patents.

Case Study 2: JinkoSolar vs. LONGi Energy (Multi-Continent Battle Royale)

Domestic Litigation Onslaught

December 2024 ignited what industry analysts now call “Solar’s World War III.” JinkoSolar launched the opening campaign in Jiangsu’s Suzhou Intermediate Court, targeting LONGi’s TOPCon production. Within weeks, the combat theater expanded to Nanchang Intermediate Court (January 2025) and Jinan Intermediate Court where LONGi filed retaliatory claims. These three parallel Chinese proceedings set the stage for February-March 2025 trial dates with potential injunctions affecting gigawatts of production capacity.

Global Litigation Theater Expansion

The conflict metastasized beyond Chinese borders at astonishing speed:

- Northern District of California: Jinko claims LONGi violates U.S. TOPCon module distribution

- Tokyo District Court: Japanese market exclusion battle

- Federal Court of Australia: Southern Hemisphere technology blockade

- Eastern District of Texas: LONGi’s counterattack on US Patent 9,515,214

- Munich UPC Branch: European patent infringement actions

This geographical sprawl represents a strategic evolution in solar IP wars. Manufacturers now engage in “simultaneous multi-jurisdictional enforcement” – suiting rivals in every major solar market simultaneously to maximize settlement pressure. The Munich filing before Europe’s new Unified Patent Court (UPC) proves particularly significant as the UPC enables pan-European injunctions with a single ruling.

Case Study 3: JA Solar vs. Astronergy (European Patent Ground Zero)

Targeted European Enforcement

JA Solar’s surgical July 2024 litigation against Astronergy (a subsidiary of China’s Chint Group) in Hamburg and Munich courts demonstrated precision targeting. The patent EP2787541B1 (“Solar Cell”) covers the fundamental TOPCon tunnel oxide/polysilicon layer interface architecture. By seeking Unified Patent Court injunctions against specific Astronergy TOPCon products like the ASTRO N5 series, JA Solar pursued maximum disruption with minimal exposure.

Component-Level Patent Warfare

Unlike whole-module disputes, this action exemplifies “atomic-level patent strategy.” JA Solar’s complaints focus on microscopic elements: tunneling silicon oxide (Si02) layer thickness tolerances under 2nm, specific phosphorus doping concentrations in polysilicon contacts, and electrode metallization patterns preventing recombination. These technical specifics reveal the increasing sophistication of solar IP litigation, where manufacturing recipes become legal evidence.

Section 3: Industry Impact & Strategic Implications

Collateral Damage in the Innovation Ecosystem

The ongoing disputes create complex ripple effects throughout the solar supply chain:

- Module distributors report delayed shipments as customs officials scrutinize TOPCon products

- Financiers increasingly demand “patent indemnity clauses” in project financing

- Engineering procurement contractors build 20% cost contingencies for patent disputes

- Tier 2 manufacturers face licensing demands before tooling installations

Leadership Perspectives on Industry Crossroads

LONGi Chairman framed the conflict as growing pains: “Persistent supply-demand imbalance and excessive internal competition require solutions beyond price wars. Protecting innovation achievements is fundamental to industry health.” His comments reflect concerns that perpetual litigation could slow TOPCon deployment precisely when climate goals demand accelerated adoption.

Trina Solar CEO proposed collaborative solutions: “While protecting IP is crucial, we must foster healthy competition within the TOPCon ecosystem through patent pools or cross-licensing frameworks.” This industry-first attitude recognizes the counterproductive nature of mutually-assured litigation destruction.

Conclusion: Beyond the Patent Battlefield

The TOPCon patent wars represent more than corporate squabbles – they’re a proxy battle over who controls humanity’s energy future. With the International Energy Agency projecting TOPCon will capture 60% of solar manufacturing by 2028, the outcome will redefine global energy geopolitics.

Yet emerging models suggest alternative pathways: LONGi and Trina’s research collaboration on TOPCon bifacial performance indicates competitors can simultaneously compete and collaborate. The recent formation of the 800G TOPCon Patent Pool signals industry maturation beyond litigation brinkmanship.

For manufacturers navigating this turbulence, strategic imperatives emerge:

- Conduct immediate freedom-to-operate analysis for TOPCon production lines

- Implement blockchain-secured manufacturing documentation systems

- Develop portfolio assets for cross-licensing negotiations

- Diversify technology roadmaps beyond single-architecture dependency

As JA Solar’s declaration “更高发电量,更高可靠性” (“Higher Power Generation, Higher Reliability”) suggests, the ultimate winner isn’t whichever company collects the most royalties, but whichever accelerates the solar transition most effectively. In this high-stakes game, patents are merely the playing field – sustainable energy transformation remains the prize.