For international buyers operating in China, contract disputes present unique challenges that require careful navigation of the local legal landscape. Our recent experience with a breach of contract case offers valuable insights into this complex process.

Overview of the Breach of Contract Case

While we always strive to work with dependable and responsible suppliers, sometimes challenges arise. This became clear when we placed an order with a new factory for CNC machining of 6-meter-long aluminum profiles. Initially, everything seemed promising: samples were approved, a trial order was halfway completed, and the factory appeared responsive and diligent. It looked like the beginning of a strong partnership—until we placed the full-scale order.

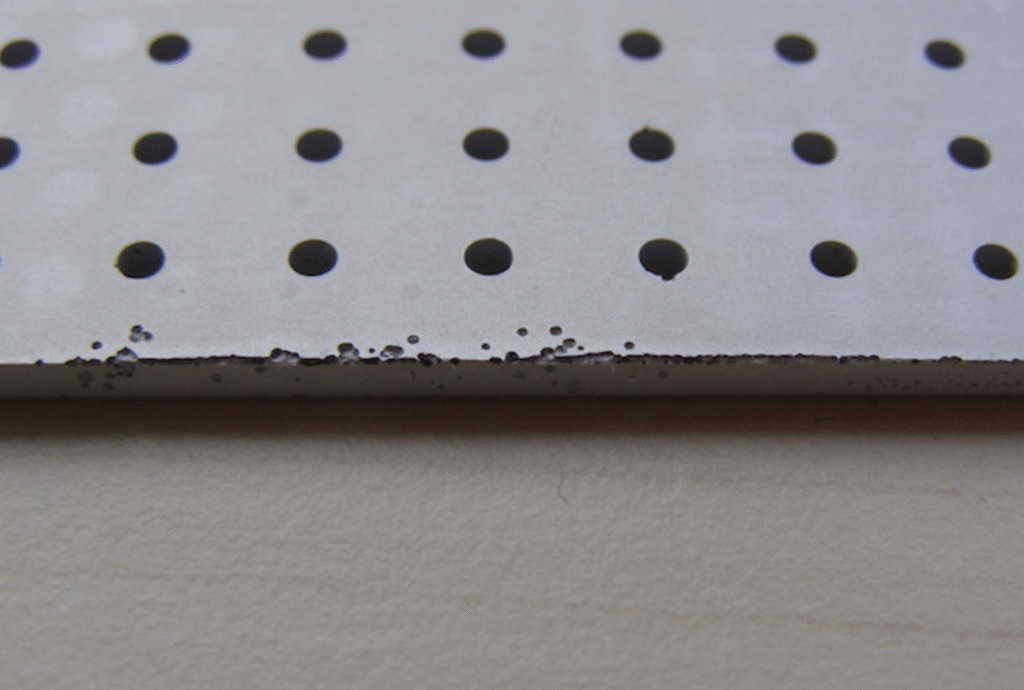

Machining these long profiles was particularly demanding, as we required flawless surfaces without scratches or blemishes—a standard we later slightly relaxed to accommodate feasibility. This necessitated careful post-machining inspections, especially since raw materials occasionally arrived with imperfections that the factory needed to identify before machining.

Unfortunately, the factory soon became overwhelmed with other orders, deprioritized our project, and failed to meet our repeated requests for timely completion. Unmachined raw aluminum profiles were left unpacked in their workshop. Although we had agreed to pay a deposit covering material costs, ambiguous contract language (despite a verbal agreement that the factory would source raw materials) led them to blame us for material defects. Notably, they had no written record of raising this issue before the delivery deadline. After two months, we switched to a new supplier to resume production and, three months later, initiated legal action against the original factory.

Outcome of the Court Hearing

The hearing lasted from 9:00 AM to about 1:30 PM. Both parties initially presented their arguments and evidence vigorously. A turning point came when the judge moved to mediation, meeting privately with each side. Upon returning, the factory agreed to refund approximately $21,500. Since our initial deposit was $27,500, and after deducting attorney fees, our net loss was around $7,500. Considering the time and effort involved in prolonged litigation, we accepted the mediation outcome. While we didn’t recover all losses, the resolution felt fair compared to the best- and worst-case scenarios outlined by our lawyer.

Key Insights for Resolving Breach of Contract Disputes in China

- Winning doesn’t always mean full compensation: Legal rulings rarely award full damages, and punitive damages are uncommon. Insufficient evidence can also result in partial liability for the buyer, even for minor, unintended breaches.

- Liquidated damages claims may be adjusted: Pre-agreed fixed damages clauses are common but must be carefully drafted. Courts typically uphold amounts aligned with actual losses; excessive claims may be reduced. In China, claiming about 130% of actual losses usually avoids reductions. Rates like 0.05% per day for late delivery are generally accepted.

- Large liquidated damages can be upheld with strong proof: For example, suppliers to major manufacturers may face substantial fines if delays cause production line shutdowns. Such claims require clear evidence of actual losses and are more feasible for large, China-based companies.

- Quality disputes are challenging: Buyers disputing product quality face higher risks, as verifying non-conformity is often subjective and time-consuming. Judges rely on third-party assessments, and disputes over measurable criteria are easier to resolve than those involving visual or material quality. Additional complexities include inspection locations, subcontractor involvement, and sample sizes. While quality disputes can be won, it’s often simpler to pursue claims related to delays or payment issues.

- Court mediation vs. judgment: Mediation offers a faster, less adversarial resolution with binding, non-appealable outcomes. It requires mutual agreement rather than strict proof, involves lower fees, and keeps details confidential, protecting reputations.

Practical Tips for International Buyers

From a risk management standpoint, this experience highlights the importance of thorough contract documentation and proactive dispute handling. Clear contract language—especially regarding quality standards and material responsibilities—is essential for effective dispute resolution. Keeping detailed transaction records, including communications, inspection reports, and payment proofs, strengthens legal positions when conflicts arise. Most importantly, addressing performance issues early can prevent minor problems from escalating into major legal disputes.

For international buyers, working with qualified local legal counsel is vital to navigate China’s unique commercial legal environment. Professional legal advice assists with contract drafting, evidence gathering, and procedural requirements that differ significantly from Western legal systems. This expertise is particularly valuable when deciding whether to pursue formal litigation or seek mediated settlements.

The case also underscores the practical difficulties of enforcing quality standards in manufacturing contracts. While buyers naturally want to maintain high product standards, overly strict requirements may unintentionally create contractual vulnerabilities. Striking the right balance between quality expectations and practical feasibility requires careful consideration of both technical capabilities and legal enforceability.

Ultimately, this experience shows that successful contract management in China demands equal focus on commercial relationships and legal protections. Although the legal system offers mechanisms for dispute resolution, the most effective approach combines clear contract terms, comprehensive documentation, professional legal support, and pragmatic conflict resolution strategies. Together, these elements help safeguard international buyers’ interests while fostering productive supplier relationships in China’s dynamic manufacturing sector.