In recent years, an increasing number of Chinese brands have confidently entered the international market by acquiring well-known foreign brands. Today, renowned names such as Arc’teryx, G-III, Paladin, Bogner, and THG—previously celebrated worldwide—are now proudly included in the portfolios of Chinese companies. These brands have been integrated into a strategic framework developed by Chinese enterprises, highlighting the rich and diverse appeal of Chinese branding on the global stage. Intellectual property, as a crucial asset for maintaining competitive advantage, has become a fundamental element in China overseas acquisition strategies. By carefully assessing risks and aiming to maximize the protection and acquisition of their rights, Chinese companies are effectively managing the transfer, restructuring, and value enhancement of intellectual property associated with these international brands.

As Chinese brands continue to globalize, many companies have strategically prioritized acquiring overseas brands. Since 2019, despite a slowdown caused by the pandemic, over 20 acquisitions of foreign consumer brands by Chinese firms have taken place. Arc’teryx, founded in Canada in 1989, is a renowned sports brand, while Salomon, established in France in 1947, specializes in mountain outdoor trail gear. Both brands operate under Amer Sports, which is now a subsidiary of the Anta Group. In February 2024, Amer Sports achieved a highly successful IPO on the New York Stock Exchange, raising $1.3 billion and significantly elevating Anta Group position in the global sportswear market.

Anta Strategic Acquisitions: FILA and Amer Sports

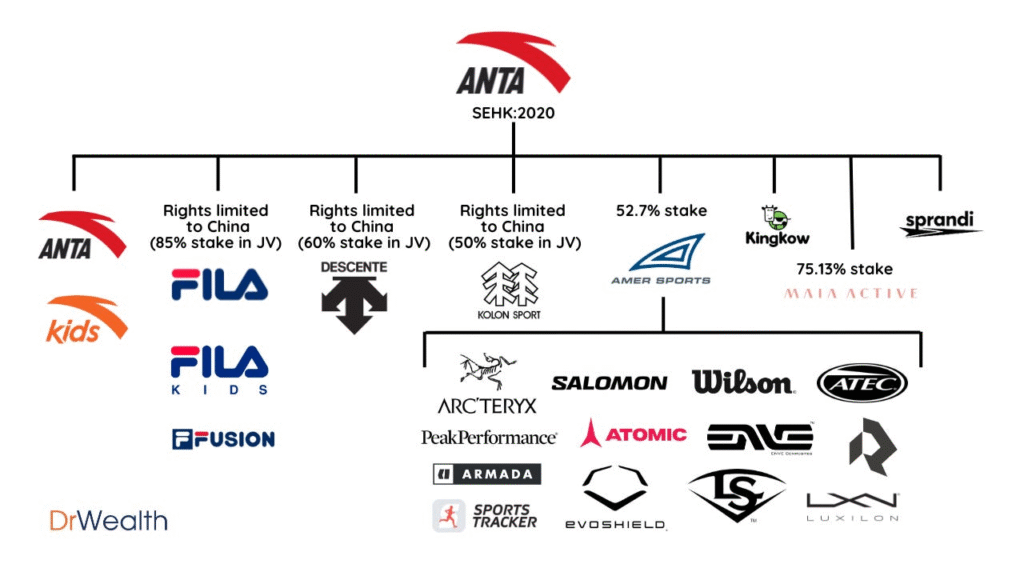

Bringing international brands into its portfolio is a key element of Anta CEO Ding Shizhong vision—not to become China Nike, but to establish the world Anta. In 2009, inspired by Lenovo acquisition of IBM PC business, Ding invested $320 million to acquire the Chinese operations of the prestigious Italian sports brand FILA. This move opened doors to the high-end overseas market and generated significant profits. In 2023, FILA contributed 25.1 billion yuan, approximately 40% of Anta Group total revenue, with gross profits surpassing those of ANTA itself.

Building on this success, between 2015 and 2017, Anta acquired several brands including the British fashion sports brand Spandi, the Chinese operations of Japan high-end sports brand Descente, and Korea well-known outdoor brand Kolon. In 2019, Anta partnered with an external consortium to acquire Amer Sports for 4.66 billion euros. This major acquisition increased Anta debt substantially—from 7.854 billion yuan to 20.157 billion yuan—prompting Ding to describe it as the heaviest decision of his career. However, five years later, Amer Sports successful U.S. IPO in February 2024, with a market capitalization of $6.3 billion, has brought Anta closer to its ambitious double 100 billion revenue goal.

With Amer Sports, Anta now owns prominent brands such as Arc’teryx, Salomon, and Wilson, enabling comprehensive market coverage from mass to high-end segments and catering to diverse consumer groups worldwide. On its 30th anniversary in 2021, Anta unveiled a new ten-year strategy focused on single focus, multi-brand, globalization, replacing the previous emphasis on omnichannel with a stronger global outlook.

To accelerate international growth, Anta restructured in January 2023 into four main segments: ANTA, FILA, Amer Sports, and other brands. Xu Yang, formerly leading Arc’teryx development, was appointed CEO of ANTA to leverage his experience with foreign-invested brands and drive globalization efforts. Subsequently, ANTA expanded rapidly in Southeast Asia, opening its first store in Bangkok in October 2023, and operating 40 stores each in the Philippines and Malaysia by year-end. On March 6, 2024, ANTA launched its first-generation Kai 1 basketball shoes in the U.S., which sold out within minutes on its American official website, marking a strong entry into the U.S. market.

Between 2019 and 2024, Chinese companies have undertaken international purchasing activities:

| Acquirer | Introduction | Target Information | Funding and Acquisition Ratio | Date |

|---|---|---|---|---|

| Ausnutria Dairy | High-end dairy and nutrition food company | Dutch sheep milk processing and cheese making company Amarlith Group | 18.4 million euros, 50%, fully acquired | August 2024 |

| DayDayCook | Quick meal and fast cooking brand | Asian flavor food brand Omsom founded in the United States, established in 2020 | Millions of dollars, 100% | June 2024 |

| Qingdao Fire & Security | Firefighting products | Fireblitz Group, four companies, including the UK independent detector brand | No more than $13 million, 75% | May 2024 |

| Jiangnan Garment | Fashion clothing, footwear | UK pioneering furniture design brand Established&Sons | Tens of millions of pounds, 80% | March 2024 |

| JieXia Home Furnishings | Home intelligence overseas brand | US old furniture retailer Z Gallerie, established in 1979 | 7.2 million US dollars | March 2024 |

| Dajian Cloud Warehouse | Foreign trade B2B trading platform | US furniture e-commerce brand Noble House | 85 million US dollars in cash | November 2023 |

| SHEIN | Fast fashion brand | UK Frasers Group’s women’s fashion brand Missguided | 100% | October 2023 |

| Haidilao | Chain hot pot brand | New York Chinese restaurant brand Hao Noodle | 3.04 million US dollars, 80% | April 2023 |

| Biemlf | China’s first stock of golf apparel | International men’s luxury brand CERRUTI 1881, KENT&CURWEN | 57 million euros, 38 million euros | April 2023 |

| USHOPAL | Chinese high-end beauty brand group | UK high-end skincare brand Argentum | 100% management rights and decision-making rights in Asia | October 2022 |

| Water Goat | Beauty company listed, core brands Evidens de Beaute, Yunni Fang | French high-end skincare brand EDB | – | July 2022 |

| Oppein Home Furnishings | Leader in Chinese customized home furnishings | Italian modern furniture brand Former Srl | 4.6 million euros | May 2022 |

| Sound Electronics | Intelligent wearable equipment brand, Xiaomi ecosystem enterprise | Northern Europe’s well-known outdoor sports watch brand Suunto | – | January 2022 |

| HARMAY | Multi-brand beauty store | US professional makeup brand Kevyn Aucoin | – | November 2021 |

| Qumeijia | Well-known domestic furniture brand | Norwegian high-end home brand Ekornes | 548 million yuan, acquired the remaining 95% equity | July 2021 |

| Yixian E-commerce | Perfect Diary’s parent company | International high-end skincare brand Eve Lom, founded in London in 1985 | – | March 2021 |

| Li Ning | Sports goods company | UK footwear brand Clarks | – | November 2020 |

| Yixian E-commerce | Perfect Diary’s parent company | French high-end beauty brand Galénic | – | November 2020 |

| Mengli | High-quality mattress and related sleep product company | US home furnishing comprehensive retailer MOR | 46.456 million US dollars, 85% | February 2020 |

| Mengniu | Global dairy top eight, China’s leading dairy product enterprise | Australia’s second-largest dairy company Lion-Dairy&Drinks | – | November 2019 |

| Mengniu | Global dairy top eight, China’s leading dairy product enterprise | Australian organic infant formula and baby food manufacturer | – | September 2019 |

| Anta | Leading domestic sports goods company | Bellamy’s Australia Limited | 460 million euros, 98.11% equity | March 2019 |

| Yili | Global dairy top five, Asia’s number one dairy product enterprise for 10 consecutive years | New Zealand’s second-largest dairy company Westland | 1.1 billion yuan, 100% equity | March 2019 |

Dongguan Liesheng Electronics Acquires Suunto

Following its acquisition by Anta, Amer Sports undertook strategic streamlining to optimize its brand portfolio, divesting cycling brand Mavic (2019), fitness equipment brand Precor (2021), and smart watch brand Suunto (2022). Suunto, a Nordic outdoor sports watch brand founded in 1936 and known for innovation in sports watches, dive computers, and precision instruments, was acquired by Dongguan Liesheng Electronics Technology. Established in 2015 as part of the Xiaomi ecosystem, Liesheng specializes in wireless audio with R&D centers in Shenzhen and Dongguan. Its Haylou brand has achieved global success, including the award-winning Haylou RS3 smartwatch.

Liesheng sought a technology-driven brand to support its international expansion, and Suunto, undervalued under Amer Sports, was an ideal fit. Liesheng emphasized that beyond Suunto’s heritage, the acquisition opens opportunities to enter new markets and product categories. Suunto team believes that Liesheng strong technology and R&D foundation will better unlock the brand full potential.

JNBY Acquires Majority Stake in Established & Sons

In March 2024, JNBY invested tens of millions of pounds to acquire an 80% stake in Established & Sons, a British avant-garde furniture design brand. Meanwhile, Jessia Home acquired the American furniture retailer Z Gallerie. As a domestic designer fashion brand, JNBY acquisition reflects both its global ambitions and cross-industry expansion. Although JNBY revenue is predominantly from China (98.5%), with limited overseas income, the company has sought to expand internationally since 2009. Its brand portfolio includes women, men, children wear, and home goods, though not furniture. The partnership with Established & Sons aligns through their shared identity as designer brands, aiming to foster resource exchange and collaboration in global design.

Jessia Home Acquires Z Gallerie

Chinese buyers highly value overseas brands design capabilities, operational experience, and established sales channels. Jessia Home acquired the bankrupt Z Gallerie for $7.2 million, including its brand, extensive product portfolio, online and offline platforms, trademarks, domain names, a 230,000-square-foot warehouse in California, and employees.

GigaCloud Technology Acquiring Noble House

GigaCloud Technology invested $85 million to acquire the bankrupt American furniture company Noble House, including inventory, warehouse leases, websites, trademarks, patents, customer contracts, and sales channels. Founder Larry Wu highlighted that the acquisition added over 2.3 million square feet of warehouse space, enhancing distribution, inventory, and customer reach.

Operating self-owned overseas warehouses not only optimizes logistics but also generates revenue. For example, Loctek overseas warehouses contributed 951 million yuan in revenue in 2023, underscoring why Jessia Home and GigaCloud Technology prioritize such assets.

Best Practices for Overseas Acquisitions

Before acquiring overseas brands, companies must carefully select targets aligned with their strategic goals and market trends. Comprehensive legal and commercial due diligence is essential, focusing on operational status, financial health, and especially intellectual property (IP). Ensuring clear, independent, and unrestricted IP ownership is critical, as IP issues pose significant risks to acquisition success. Acquisition agreements should include detailed representations and warranties regarding IP rights and any external licenses. Given varying international IP laws and classifications, the types of rights involved must be clearly defined.

While acquisitions offer great potential, they also carry operational challenges. Success depends not only on capital transfer but also on integrating cultures and values. Maintaining the acquired brand heritage and customer loyalty is vital, which may involve retaining original R&D, design, management, and sales teams to ensure continuity and stability. Ppreserving a brand core DNA and cultural heritage is fundamental to sustaining its value. At the same time, products should be adaptively tailored to meet the needs of diverse markets.